BC Assessment: North Central BC 2026 Property Assessments Announced

PRINCE GEORGE, British Columbia, Jan. 02, 2026 (GLOBE NEWSWIRE) -- The 2026 property assessments, which reflect market value as of July 1, 2025, have been announced for property owners of about 250,000 properties throughout North Central BC. The updated property values are now available at bcassessment.ca in addition to 2026 Property Assessment Notices being mailed to each property owner.

“The North Central real estate market remains stable which is being reflected in the 2026 property assessments,” says BC Assessment Deputy Assessor Jarret Krantz. “Most homeowners can generally expect value changes in the range of -5% to +15% with some exceptions depending on the community.”

As B.C.'s provider of property assessment information, BC Assessment collects, monitors and analyzes property data throughout the year. The newly released 2026 property assessment details can be searched and accessed any time at bcassessment.ca by using BC Assessment’s Assessment Search online service.

Overall, North Central BC’s total assessments increased from over $99.8 billion in 2025 to about $104.7 billion this year. A total of almost $1 billion of the region’s updated assessments is from new construction, subdivisions and the rezoning of properties.

The North Central BC region encompasses approximately 70% of the province: stretching east to the Alberta border, north to the Yukon border, west to Bella Coola including Haida Gwaii and to the south, just north of Clinton.

The summaries below provide estimates of typical 2025 versus 2026 assessed values of properties throughout the region. These examples demonstrate market trends for single-family residential properties by geographic area:*

|

Single Family Homes Changes by Community |

2025 Typical Assessed Value as of July 1, 2024 |

2026 Typical Assessed Value as of July 1, 2025 |

% Change |

|||

| District of 100 Mile House | $397,000 |

$398,000 |

0% |

|||

| Village of Burns Lake | $265,000 |

$273,000 |

+3% |

|||

| Bella Coola Rural Area | $247,000 |

$268,000 |

+8% |

|||

| District of Chetwynd | $261,000 |

$277,000 |

+6% |

|||

| Village of Daajing Giids | $396,000 |

$428,000 |

+8% |

|||

| City of Dawson Creek | $282,000 |

$291,000 |

+3% |

|||

| District of Fort St James | $214,000 |

$244,000 |

+14% |

|||

| City of Fort St John | $345,000 |

$352,000 |

+2% |

|||

| Village of Fraser Lake | $199,000 |

$206,000 |

+4% |

|||

| Village of Granisle | $102,000 |

$113,000 |

+12% |

|||

| Village of Hazelton | $268,000 |

$293,000 |

+10% |

|||

| District of Houston | $262,000 |

$264,000 |

+1% |

|||

| District of Hudson's Hope | $198,000 |

$204,000 |

+3% |

|||

| District of Kitimat | $344,000 |

$364,000 |

+6% |

|||

| District of Mackenzie | $173,000 |

$184,000 |

+6% |

|||

| Village of Masset | $232,000 |

$251,000 |

+8% |

|||

| Village of McBride | $213,000 |

$237,000 |

+11% |

|||

| District of New Hazelton | $223,000 |

$241,000 |

+8% |

|||

| Northern Rockies Regional Mun | $149,000 |

$151,000 |

+2% |

|||

| Village of Port Clements | $194,000 |

$229,000 |

+18% |

|||

| District of Port Edward | $286,000 |

$333,000 |

+16% |

|||

| Village of Pouce Coupe | $214,000 |

$232,000 |

+8% |

|||

| City of Prince George | $451,000 |

$459,000 |

+2% |

|||

| City of Prince Rupert | $417,000 |

$429,000 |

+3% |

|||

| Queen Charlotte (Haida Gwaii) | $304,000 |

$326,000 |

+7% |

|||

| City of Quesnel | $339,000 |

$352,000 |

+4% |

|||

| Town of Smithers | $506,000 |

$527,000 |

+4% |

|||

| District of Stewart | $179,000 |

$179,000 |

0% |

|||

| District of Taylor | $220,000 |

$257,000 |

+17% |

|||

| Village of Telkwa | $434,000 |

$478,000 |

+10% |

|||

| City of Terrace | $484,000 |

$506,000 |

+5% |

|||

| District of Tumbler Ridge | $203,000 |

$200,000 |

-2% |

|||

| Village of Valemount | $320,000 |

$327,000 |

+2% |

|||

| District of Vanderhoof | $335,000 |

$337,000 |

+1% |

|||

| District of Wells | $175,000 |

$189,000 |

+8% |

|||

| City of Williams Lake | $419,000 |

$440,000 |

+5% |

|||

| *All data calculated based on median values. | ||||||

These examples demonstrate market trends for strata residential properties (e.g. condos/townhouses) by geographic area for select North Central BC urban centres:*

|

Strata Homes (Condos/Townhouses) Changes by Community |

2025 Typical Assessed Value as of July 1, 2024 |

2026 Typical Assessed Value as of July 1, 2025 |

% Change |

|||

| City of Prince George | $265,000 |

$273,000 |

+3% |

|||

| City of Fort St John | $175,000 |

$185,000 |

+6% |

|||

| City of Dawson Creek | $172,000 |

$181,000 |

+5% |

|||

| District of Kitimat | $261,000 |

$276,000 |

+6% |

|||

| Town of Smithers | $408,000 |

$408,000 |

0% |

|||

| City of Terrace | $240,000 |

$251,000 |

+5% |

|||

| City of Williams Lake | $191,000 |

$193,000 |

+1% |

|||

| *All data calculated based on median values. | ||||||

BC Assessment’s website at bcassessment.ca includes more details about 2026 assessments, property information and trends such as lists of 2026’s top valued residential properties across the province and an interactive map.

The website also provides self-service access to a free, online property assessment search service that allows anyone to search, check and compare 2026 property assessments for anywhere in the province. Property owners can also download a digital copy of their 2026 property assessment.

“Property owners can find valuable information on our website including answers to many assessment-related questions, and those who feel that their property assessment does not reflect market value as of July 1, 2025 or see incorrect information on their notice, should contact BC Assessment as indicated on their notice as soon as possible in January,” says Krantz.

“If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a Notice of Complaint (Appeal) by February 2, for an independent review by a Property Assessment Review Panel,” adds Krantz.

The Property Assessment Review Panels, independent of BC Assessment, are appointed annually by the provincial government, and typically meet from early February to mid-March to hear formal complaints.

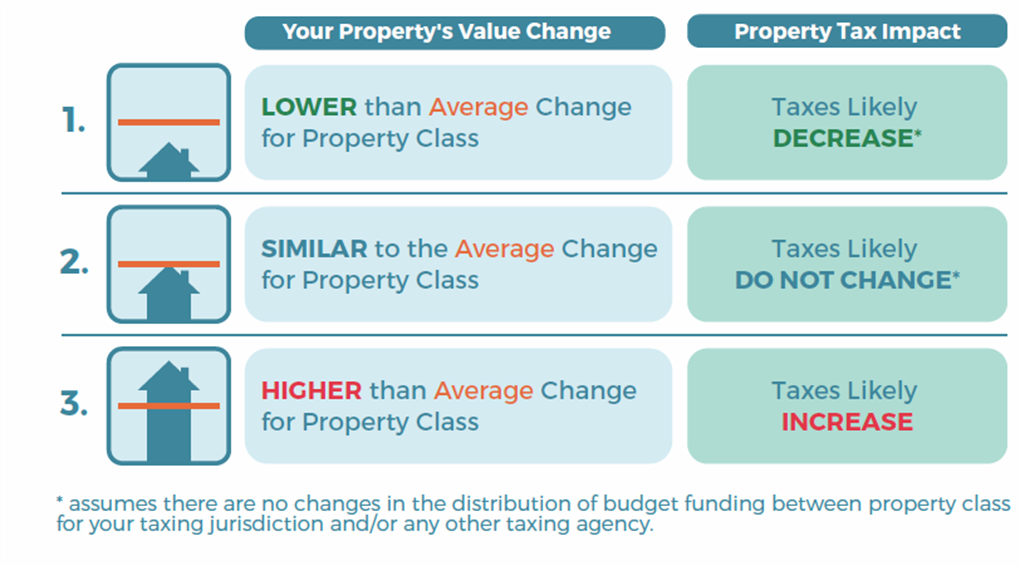

"It is important to understand that changes in property assessments do not automatically translate into a corresponding change in property taxes," explains Krantz. "As noted on your assessment notice, how your assessment changes relative to the average change in your community is what may affect your property taxes."

Have questions?

Property owners can contact BC Assessment toll-free at 1-866-valueBC (1-866-825-8322) or online at bcassessment.ca. During the month of January, hours of operation are 8:30 a.m. to 5:00 p.m., Monday to Friday.

Media contact:

Jarret Krantz

Deputy Assessor, North Central BC

BC Assessment

Tel. 1.866.825.8322 Ext. 26278/ Cell 778-349-1298

Email: jarret.krantz@bcassessment.ca

Two PDF Attachments:

Please see attached British Columbia's 2026 Top 500 Valued Homes list and North Central BC's Top 100 Valued Homes list at:

http://ml.globenewswire.com/Resource/Download/42678e8a-dfd6-4f5a-a2b6-6d37b8c03051

http://ml.globenewswire.com/Resource/Download/375aa4c7-8b48-4a91-8567-a62963b54ce5

An infographic accompanying this announcement is available at: https://www.globenewswire.com/NewsRoom/AttachmentNg/47d4fbce-26b0-431f-93d2-c7be7f90187b

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.